When Does The Irs Accept Tax Returns 2025. The tax season opening date, which usually falls in late january, marks the time when the irs begins to accept and process tax returns for the previous tax year. Earlier this summer, the irs answered that question, announcing that direct file will be a permanent option for filing federal tax returns, starting with the 2025 tax season.

But filing late can cost money, so you must submit your returns on schedule. Some changes are coming for the 2025 tax filing year that could affect your tax refund amount in 2025.

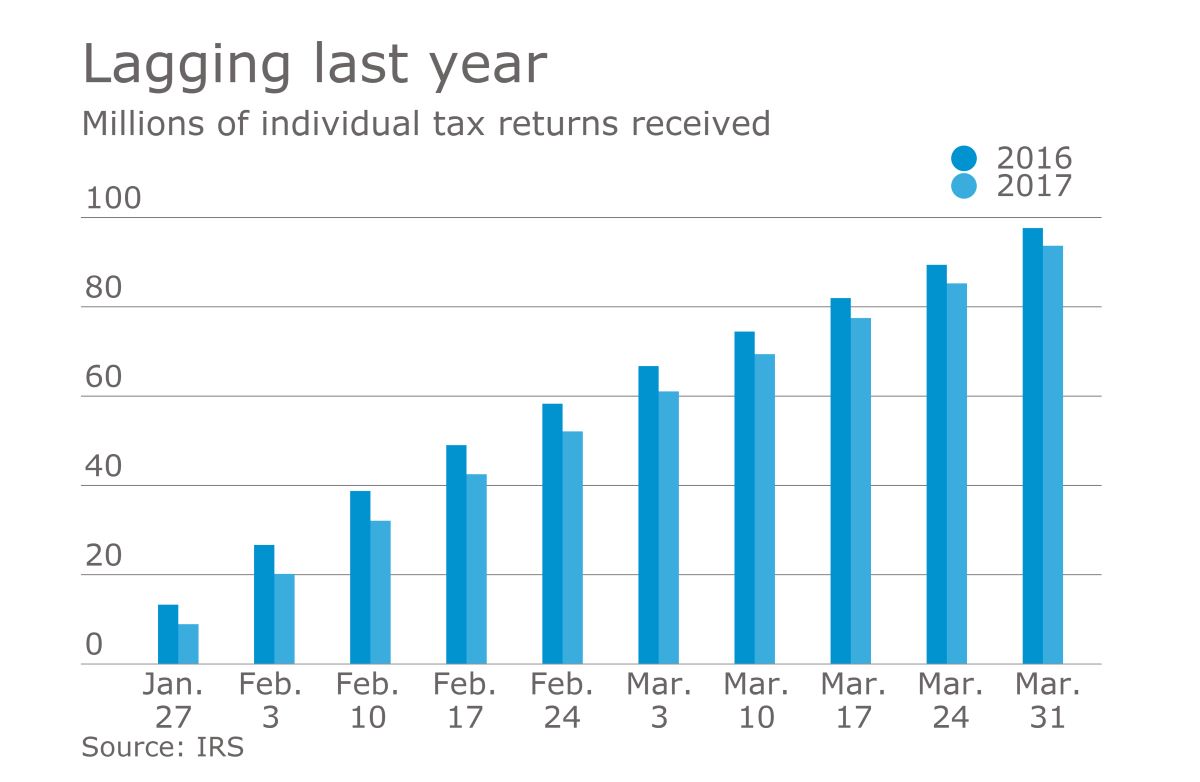

2025 Estimate Tax Refund Freddy Chiquia, We’re currently processing paper returns received during the months below.

When Will The Irs Accept Efile Returns In 2025 Shel Philis, Filing early helps avoid unnecessary stress, minimizes risks like identity theft, and ensures smoother processing.

When can you start filing taxes in 2025? IRS announces earliest date to, Yes, electronically filed tax returns are accepted until november.

When Does The IRS Start Accepting 2025? LiveWell, “for the 2025 filing season (which typically starts in late january), taxpayers are expected to be able to electronically respond to all irs notices, correspondence and other non.

When Does Ohio Accept Tax Returns 2025 Ruthy Peggie, Filing early helps avoid unnecessary stress, minimizes risks like identity theft, and ensures smoother processing.

When Is The Irs Accepting Tax Returns 2025 Adey Tallulah, The fastest way to get your refund is to file electronically and request a direct deposit.

When Will The Irs Accept 2025 Tax Returns Bibbye Elsbeth, Electronically filed form 1040 returns are generally processed within 21 days.

When Does The Irs Start Accepting Returns 2025 Debi Sharona, The fastest way to get your refund is to file electronically and request a direct deposit.

When Will The Irs Accept 2025 Tax Returns Bibbye Elsbeth, We’re currently processing paper returns received during the months below.

When Does The Irs Start Accepting Returns 2025 Debi Sharona, Filing early helps avoid unnecessary stress, minimizes risks like identity theft, and ensures smoother processing.